Why Tax Evasion Memes Are Capturing Public Attention In 2023

Tax evasion has long been a contentious issue worldwide, sparking debates, controversies, and now, even memes. In today's digital age, the internet has transformed how people engage with complex topics like tax avoidance and evasion. The rise of "tax evasion meme" culture reflects a growing public interest in holding individuals and corporations accountable for their financial practices. These humorous yet thought-provoking images have become a unique way to discuss serious issues while sparking conversations about transparency and fairness in taxation.

As global economies continue to grapple with financial inequality, the use of memes to highlight tax evasion has surged in popularity. Platforms like Twitter, Reddit, and Instagram are flooded with creative content that blends humor with awareness. This cultural phenomenon is not just entertainment—it serves as a powerful tool for educating the masses about the intricacies of tax laws and the consequences of non-compliance. By using relatable visuals and sharp wit, creators are making an otherwise dry topic more accessible.

For many, the appeal of "tax evasion meme" culture lies in its ability to simplify complex legal and financial jargon into digestible content. Memes often expose the absurdity of evading taxes while emphasizing the importance of contributing to society. This article delves into the origins, impact, and significance of these memes, providing insights into why they resonate so deeply with audiences worldwide.

Read also:5 Essential Tips For A Healthier Lifestyle Expert Advice For Longterm Wellbeing

What Is the Role of Memes in Modern Tax Discussions?

Memes have evolved far beyond simple jokes; they now serve as a medium for social commentary and critique. When it comes to tax evasion, memes act as a bridge between public sentiment and the often convoluted world of finance. They simplify complex ideas, making them relatable to everyday people. For instance, a popular "tax evasion meme" might depict a wealthy individual trying to hide money under a mattress, highlighting the absurd lengths some go to avoid paying their fair share.

Moreover, memes often reflect broader societal concerns about wealth distribution and accountability. By using humor, creators can address serious issues without overwhelming their audience. This approach not only increases engagement but also fosters a sense of community among those who share similar values and opinions on tax fairness.

How Do Tax Evasion Memes Influence Public Perception?

The influence of "tax evasion meme" culture extends beyond mere entertainment. These creations shape public opinion by presenting facts in an engaging format. Research shows that people are more likely to remember information presented through humor, making memes an effective educational tool. For example, a meme might illustrate the consequences of tax evasion, such as fines or imprisonment, in a way that sticks in the viewer's mind.

- Memes can spark curiosity, encouraging users to research the topic further.

- They provide a platform for discussing systemic issues related to taxation.

- By highlighting real-life examples of tax evasion, memes hold powerful entities accountable.

Ultimately, the impact of these memes lies in their ability to democratize information, ensuring that everyone has access to knowledge about tax laws and their implications.

Why Are Tax Evasion Memes So Popular Among Younger Audiences?

Younger generations, particularly Millennials and Gen Z, have embraced "tax evasion meme" culture with enthusiasm. This popularity can be attributed to several factors, including the accessibility of digital platforms and the desire for authentic content. Unlike traditional news sources, memes offer a more personal and relatable perspective on global issues.

Additionally, younger audiences appreciate the creative freedom that memes allow. Creators can experiment with different styles, from satire to exaggeration, to convey their message effectively. The viral nature of memes ensures that even niche topics like tax evasion reach a wide audience, amplifying their impact.

Read also:Did Andy Kaufman Fake His Death Unraveling The Mystery

Who Creates These Memes, and What Motivates Them?

Behind every viral "tax evasion meme" is a creator driven by passion, creativity, and a desire to make a difference. These individuals often come from diverse backgrounds, united by their interest in social justice and financial literacy. Many creators view memes as a form of activism, using humor to challenge the status quo and advocate for change.

Some creators are inspired by personal experiences with the tax system, while others draw from current events involving high-profile tax evasion cases. Regardless of their motivation, these individuals share a common goal: to educate and engage their audience on important topics. Their work not only entertains but also empowers viewers to take action and demand transparency from those in power.

Can Tax Evasion Memes Really Drive Change?

This is a question many experts and observers have pondered. While memes alone may not solve the issue of tax evasion, they play a crucial role in raising awareness and fostering discussions. By presenting information in an engaging format, memes can inspire individuals to learn more about tax laws and advocate for reform. They also serve as a reminder of the importance of civic responsibility and accountability.

Furthermore, the viral nature of memes means that messages about tax evasion can reach millions of people within hours. This rapid dissemination of information can pressure governments and corporations to address public concerns and implement stricter regulations. As such, memes are not just a form of entertainment—they are a powerful tool for driving social change.

Is There a Downside to Tax Evasion Memes?

While "tax evasion meme" culture offers numerous benefits, it is not without its drawbacks. One potential downside is the risk of oversimplifying complex issues. Memes, by their nature, prioritize brevity over depth, which can lead to misunderstandings or misinterpretations of the facts. Additionally, some memes may perpetuate stereotypes or spread misinformation if not carefully crafted.

Another concern is the potential for desensitization. Overexposure to memes about tax evasion could lead to apathy or complacency, diminishing their effectiveness as a tool for change. It is therefore essential for creators to strike a balance between humor and accuracy, ensuring that their content informs as well as entertains.

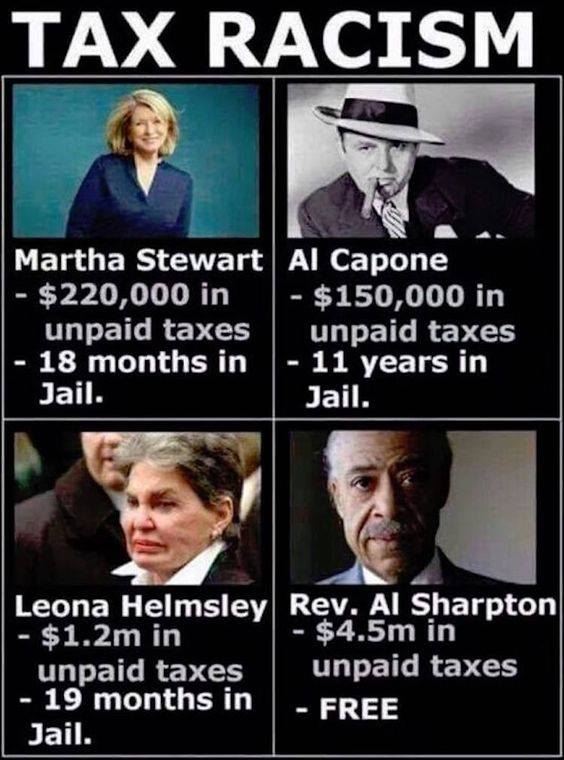

What Are Some Notable Examples of Tax Evasion Memes?

Throughout history, there have been countless examples of "tax evasion meme" culture that have captured public attention. One memorable instance involved a meme comparing tax evasion to robbing a bank, emphasizing the severity of the offense. Another popular meme used a cartoon character to illustrate the absurdity of hiding wealth in offshore accounts, sparking laughter while delivering a powerful message.

These examples demonstrate the creativity and ingenuity of meme creators in addressing serious topics. By combining humor with hard-hitting truths, they ensure that their content resonates with audiences across the globe.

How Can You Create Your Own Tax Evasion Meme?

If you're inspired to join the "tax evasion meme" movement, here are some tips to get started:

- Identify a key issue or fact about tax evasion that you want to highlight.

- Choose a relatable image or template that aligns with your message.

- Add witty text that captures the essence of the topic while maintaining accuracy.

- Test your meme with friends or on social media to gauge its effectiveness.

Remember, the best memes are those that strike a balance between humor and substance, leaving a lasting impression on viewers.

What Does the Future Hold for Tax Evasion Memes?

As technology continues to evolve, so too will the world of "tax evasion meme" culture. Advances in artificial intelligence and digital art tools may open up new possibilities for creators, enabling them to produce even more engaging and interactive content. Meanwhile, the growing importance of financial literacy and social responsibility will likely keep tax evasion at the forefront of public discourse.

Ultimately, the future of tax evasion memes depends on the creativity and dedication of those who create and share them. By continuing to innovate and adapt, creators can ensure that their work remains relevant and impactful for years to come.

Table of Contents

- What Is the Role of Memes in Modern Tax Discussions?

- How Do Tax Evasion Memes Influence Public Perception?

- Why Are Tax Evasion Memes So Popular Among Younger Audiences?

- Who Creates These Memes, and What Motivates Them?

- Can Tax Evasion Memes Really Drive Change?

- Is There a Downside to Tax Evasion Memes?

- What Are Some Notable Examples of Tax Evasion Memes?

- How Can You Create Your Own Tax Evasion Meme?

- What Does the Future Hold for Tax Evasion Memes?

- Final Thoughts on Tax Evasion Memes

Final Thoughts on Tax Evasion Memes

In conclusion, "tax evasion meme" culture represents a unique intersection of humor, education, and activism. By leveraging the power of memes, creators can tackle complex issues like tax evasion in a way that resonates with audiences worldwide. As this cultural phenomenon continues to grow, it holds the potential to drive meaningful change and promote greater transparency in financial practices.

So the next time you come across a "tax evasion meme," take a moment to appreciate the thought and effort behind it. These creations are more than just jokes—they are a testament to the power of creativity and the collective desire for a fairer, more equitable society.

Article Recommendations